Tax Year 2024: Adjusted Income Tax Rates

- 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

- 12% for incomes over $11,600 ($23,200 for married couples filing jointly)

- 22% for incomes over $47,150 ($94,300 for married couples filing jointly)

- 24% for incomes over $100,525 ($201,050 for married couples filing jointly)

- 32% for incomes over $191,950 ($383,900 for married couples filing jointly)

- 35% for incomes over $243,725 ($487,450 for married couples filing jointly)

- 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly)

Tax Year 2024: Child Tax Credit

The child tax credit will decrease if the parent or guardian's gross income surpasses $200,000 for individual returns or $400,000 for joint returns.

OUR TEAM

<M.E. Tax Services has been family-owned and operated for 10 years. Based in Atlanta, GA., LeDell and Kasi McGowan have dedicated their practice to ensuring the quality, professionalism, proficiency, and time-efficiency of each return. The best part is, the firm is completely virtual, no COVID worries. All clients can complete their returns from the comfort of their home.

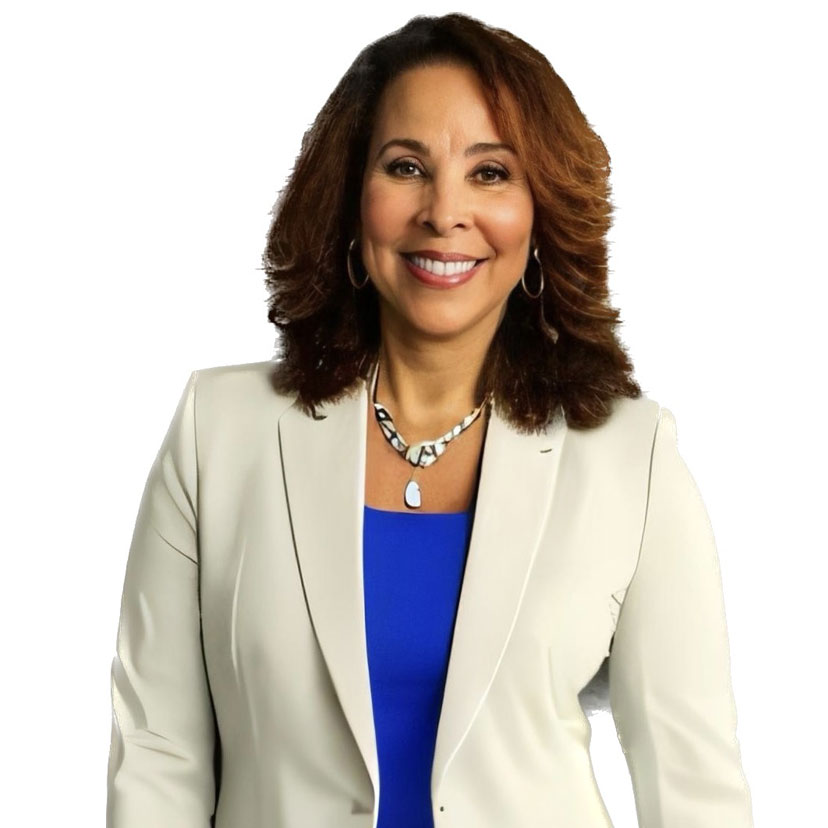

Kasi McGowan

Partner

678.353.1482

kasimcgowntax@gmail.com

LeDell McGowen

Partner

404.399.8138

mcgowanenterprizes@gmail.com